Understanding the 50/30/20 Rule in Budgeting

Managing finances can be challenging, but using a simple and effective budgeting framework can make a significant difference. The 50/30/20 framework is a popular method that helps individuals allocate their net income efficiently.

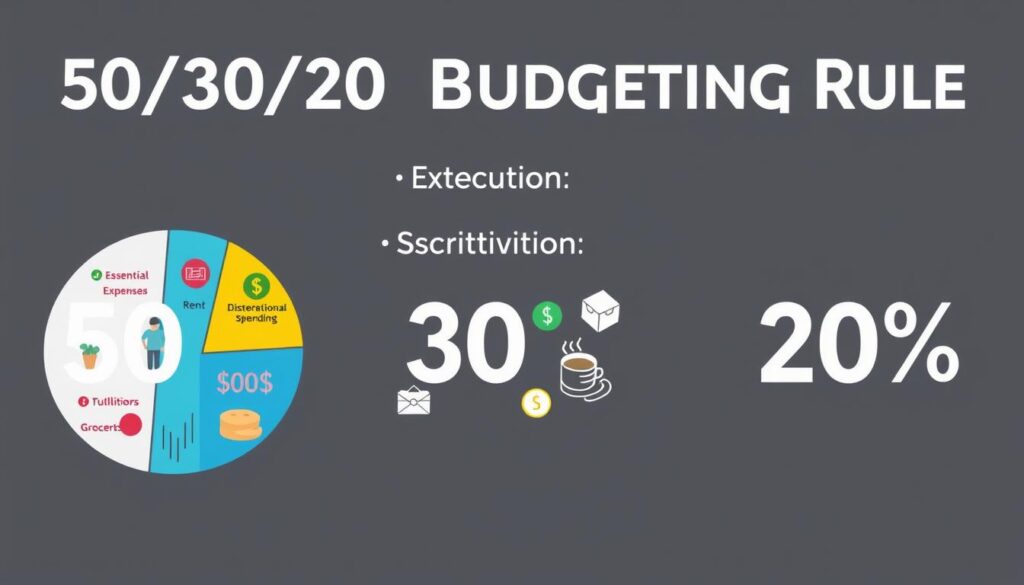

This framework suggests dividing your income into three categories: 50% for necessary expenses, such as rent and utilities, 30% for discretionary spending, and 20% for savings and debt repayment. By following this rule, individuals can prioritize their spending, achieve financial stability, and work towards their long-term goals.

By adopting the 50/30/20 framework, individuals can take control of their finances and make conscious financial decisions. This simple yet effective approach to budgeting can lead to a more stable financial future.

What is the 50/30/20 Budgeting Rule?

The 50/30/20 rule is a widely recognized budgeting principle that helps individuals allocate their income wisely. This rule involves splitting your after-tax income into three categories of spending: 50% goes to needs, 30% goes to wants, and 20% goes to savings.

Popularized by U.S. Sen. Elizabeth Warren in her book, “All Your Worth: The Ultimate Lifetime Money Plan,” the 50/30/20 rule provides a simple yet effective framework for managing finances. By dividing income into these three buckets, individuals can ensure they are meeting their financial obligations while also saving for the future.

The three categories of spending are crucial to understanding the rule. The “needs” category includes essential expenses such as rent, utilities, and groceries. “Wants” cover discretionary spending like dining out, entertainment, and hobbies. Lastly, “savings” encompasses not just savings accounts but also debt repayment and retirement funds.

By allocating 50% of after-tax income to needs, individuals can cover necessary expenses. Thirty percent is allocated to wants, allowing for some discretionary spending. Finally, 20% is dedicated to savings, ensuring a cushion for emergencies and long-term financial goals.

Implementing the 50/30/20 rule can help individuals achieve a better balance between spending and saving, leading to improved financial health and stability.

Breaking Down the Three Categories

To effectively apply the 50/30/20 rule, it’s crucial to understand its three main components: needs, wants, and savings. This understanding will help you allocate your income efficiently.

What Qualifies as a Need

Needs include essential expenses that are necessary for living. These expenses are typically non-discretionary and include costs such as utility bills, rent or mortgage payments, healthcare, and groceries. These are the expenses that you cannot easily cut back on without significantly impacting your quality of life.

A common mistake when categorizing needs is including expenses that are not entirely necessary. For example, having a very expensive phone plan or a large house that is not affordable. It’s essential to review these expenses regularly to ensure they remain necessary and affordable.

Identifying Discretionary Spending

Discretionary spending, or wants, includes expenses that are not essential for living. These can be hobbies, restaurant meals, subscription services, and entertainment. While these expenses are not necessary, they contribute to your quality of life and enjoyment.

Balancing Enjoyment and Responsibility

It’s crucial to strike a balance between enjoying your life now and being responsible with your finances. Allocating 30% of your income towards wants allows you to enjoy your life while still saving for the future and covering necessary expenses.

Emergency Funds

Emergency funds are a critical component of savings. They provide a financial cushion in case of unexpected expenses or loss of income. It’s recommended to have at least 3-6 months’ worth of expenses saved.

Debt Repayment

Using a portion of your savings for debt repayment is essential, especially for high-interest debts. Paying off debts quickly can save you a significant amount in interest over time.

Retirement and Investment

Finally, allocating a portion of your income towards retirement and investment is vital for long-term financial security. This can include contributions to a 401(k), IRA, or other investment vehicles. Starting early allows you to take advantage of compound interest.

By understanding and effectively managing these three categories, you can make the most out of the 50/30/20 rule and achieve a balanced financial life.

Understanding the 50/30/20 Rule in Budgeting: Practical Implementation

Mastering the 50/30/20 budgeting rule involves more than just understanding its components; it requires practical implementation. To effectively apply this rule, individuals must track their expenses, prioritize their spending, and make adjustments as necessary.

To start implementing the 50/30/20 rule, it’s essential to have a clear picture of your income and expenses. Tracking your expenses is the first step. This involves monitoring where your money is going each month, categorizing your spending into needs, wants, and savings.

Once you have a clear understanding of your spending habits, you can begin to prioritize your essential needs. This means allocating 50% of your income towards necessary expenses like rent, utilities, and groceries.

After covering your essential needs, you can allocate 30% of your income towards discretionary spending, such as entertainment, hobbies, and lifestyle upgrades. The remaining 20% should be dedicated to saving and debt repayment, including building an emergency fund and paying off high-interest loans.

Automating Your Savings

One effective way to ensure you stick to the 50/30/20 rule is by automating your savings. Set up automatic transfers from your checking account to your savings or investment accounts. This way, you ensure that you save 20% of your income before you have the chance to spend it.

Regularly reviewing your budget is also crucial. As your income or expenses change, you may need to adjust your allocations to stay on track. This could involve reducing discretionary spending during months when unexpected expenses arise or adjusting your savings rate during periods of financial stability.

By following these practical steps and maintaining a commitment to the 50/30/20 rule, individuals can achieve a more balanced and sustainable financial life. This approach not only helps in managing finances effectively but also in achieving long-term financial goals.

Adapting the 50/30/20 Rule to Different Life Situations

Adapting the 50/30/20 rule to different financial circumstances is crucial for effective budgeting. Individuals with varying income levels or living in areas with a high cost of living may need to adjust the proportions to suit their financial needs.

For those with a low income, allocating 50% of their income towards necessary expenses might be challenging. In such cases, they might need to allocate a larger percentage towards necessities, potentially reducing the amount available for savings and discretionary spending.

On the other hand, individuals living in areas with a high cost of living might find that 50% of their income is insufficient for necessary expenses. They may need to adjust their budget to allocate more than 50% towards necessities, which could impact their ability to save and spend on discretionary items.

For example, a person living in a high-cost city like New York or San Francisco might need to allocate 60% or more of their income towards rent, utilities, and other necessary expenses. This would leave them with 40% or less for discretionary spending and savings, requiring a significant adjustment to the traditional 50/30/20 rule.

Ultimately, the key to successfully adapting the 50/30/20 rule is to understand one’s financial situation and make adjustments accordingly. By doing so, individuals can create a budget that is tailored to their needs, helping them achieve financial stability and success.

Conclusion

The 50/30/20 rule provides a simple and effective way to manage one’s finances, enabling individuals to achieve financial stability and reach their savings goals. By allocating 50% of income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment, individuals can create a balanced budget that supports long-term financial health.

Understanding the 50/30/20 rule in budgeting is crucial for making informed financial decisions. This rule helps individuals prioritize their spending, make adjustments as needed, and stay on track with their financial objectives. By following this straightforward guideline, individuals can simplify their financial management and make progress towards achieving financial stability.