The Beginner’s Guide to Index Funds

Investing in the stock market can seem daunting, but it doesn’t have to be. One popular investment option is index funds, which track a financial index, such as the S&P 500.

By investing in index funds, you can diversify your portfolio and potentially earn long-term returns. This type of investment is ideal for those new to investing, as it provides broad market exposure and is often less expensive than actively managed funds.

Investing in index funds is a straightforward way to start building your investment portfolio. With its many benefits, it’s no wonder that index funds have become a popular choice among investors.

What Are Index Funds?

At its core, an index fund is a collection of stocks or bonds that replicates the performance of a particular market index, such as the S&P 500. This type of investment allows individuals to diversify their portfolios by pooling money into a fund that tracks a specific market index, thereby reducing risk and potentially increasing long-term returns.

Index funds work by mirroring the composition of the index they track. For example, if an index fund is designed to track the S&P 500, it will hold the same stocks in the same proportions as the S&P 500 index. This means that when the index goes up or down, the value of the index fund will similarly increase or decrease.

The benefits of index funds include broad diversification, low costs, and simplicity. They are particularly appealing to beginners because they offer a straightforward way to invest in the stock market without having to pick individual stocks or bonds.

By understanding what index funds are and how they work, investors can make informed decisions about their investment strategies.

The Benefits of Investing in Index Funds

Index funds have gained popularity due to their low costs and potential for long-term financial growth. One of the primary advantages of index funds is their ability to provide diversification, allowing investors to spread their risk across a wide range of assets, thereby reducing their exposure to any one particular stock or sector.

In addition to diversification, index funds are known for their low fees. Unlike actively managed funds, which often come with higher management fees, index funds are typically more cost-effective. This is because they are designed to track a specific market index, such as the S&P 500, rather than trying to beat it through active management.

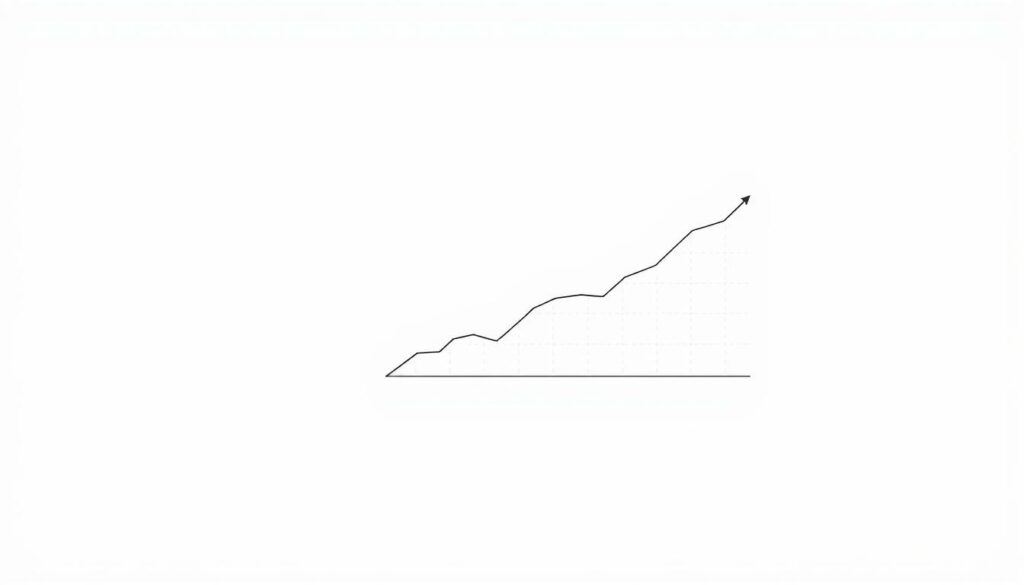

The potential for long-term growth is another significant benefit of index funds. Historically, the stock market has trended upwards over the long term, and by tracking a broad market index, index funds can provide investors with a way to tap into this growth. This makes them an attractive option for those looking to build wealth over time.

Overall, the combination of diversification, low fees, and potential for long-term growth makes index funds an appealing choice for many investors, particularly those just starting out. By understanding these benefits, beginners can make more informed decisions about their investment strategies.

Popular Types of Index Funds for Beginners

Beginners can start their investment journey with popular index funds that track various markets. These funds offer a diversified portfolio, making it easier for new investors to get started.

Developed Markets

Index funds that track developed markets, such as the S&P 500, are popular among beginners. These funds follow established markets in countries like the United States, Canada, and those in Europe. For example, the Vanguard 500 Index Fund tracks the S&P 500, providing broad exposure to large-cap U.S. stocks.

Emerging Markets

For those looking to invest in emerging markets, index funds like the ones tracking the MSCI Emerging Markets Index are available. These funds focus on countries with growing economies, such as China, India, and Brazil. The iShares MSCI Emerging Markets ETF is a well-known example, offering a diversified portfolio in emerging markets.

Both developed and emerging markets index funds offer unique benefits. Developed markets tend to be more stable, while emerging markets offer potential for higher growth. Beginners can choose one or both types based on their investment goals and risk tolerance.

How to Start Investing in Index Funds

Investing in index funds is a straightforward process that begins with opening a brokerage account. This account will serve as the platform through which you can buy and sell index funds.

To open a brokerage account, you’ll need to choose a reputable brokerage firm. Consider factors such as fees, account minimums, and the types of index funds offered. Look for brokerages with low or no fees, as these can eat into your investment returns.

Minimum Investment Requirements

Once you’ve opened your brokerage account, you’ll need to decide on an index fund to invest in. Different funds have different minimum investment requirements, ranging from a few hundred to several thousand dollars. Some brokerages also offer index funds with no minimums.

After selecting your index fund, consider setting up a regular investment schedule. This can help you invest consistently over time, reducing the impact of market volatility.

Setting Up Automatic Investments

Setting up automatic investments allows you to invest a fixed amount of money at regular intervals, such as monthly. This strategy, known as dollar-cost averaging, can help you build wealth over time without having to time the market.

By following these steps, you can start investing in index funds and begin your journey towards long-term financial goals. Remember to review your investment portfolio periodically to ensure it remains aligned with your objectives.

The Beginner’s Guide to Index Funds Strategy

Developing an effective index funds strategy is crucial for achieving long-term financial goals. Investors can use index funds to implement a variety of investment strategies, including dollar-cost averaging and long-term investing.

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the market’s performance. This strategy helps reduce the impact of market volatility and timing risks. It’s a disciplined approach that can lead to significant returns over time.

Long-term investing is another key strategy. By holding onto index funds for an extended period, investors can ride out market fluctuations and benefit from the overall growth of the market. This approach requires patience and a commitment to one’s investment goals.

To maximize the benefits of index funds, investors should also consider factors such as fees, diversification, and tax efficiency. By combining these elements with a well-thought-out strategy, investors can create a robust investment portfolio that supports their financial objectives.

Regular portfolio rebalancing is also essential to ensure that the investment strategy remains aligned with the investor’s goals and risk tolerance.

Tax Considerations for Index Fund Investors

Understanding the tax implications of index funds is crucial for maximizing your investment strategy. As an index fund investor, it’s essential to be aware of the potential tax consequences of your investments.

Capital Gains Taxes are a significant consideration. When you sell your index fund shares, you may realize capital gains, which are subject to taxation. The tax rate depends on how long you’ve held the shares.

Tax-Loss Harvesting is a strategy that can help minimize tax liabilities. By selling losing positions, you can offset gains from other investments, reducing your overall tax burden.

To optimize your tax strategy, consider consulting with a tax professional or financial advisor. They can help you navigate the complexities of tax laws and ensure you’re making the most tax-efficient decisions.

Conclusion

In The Beginner’s Guide to Index Funds, we explored the world of index funds, a simple and effective way to invest in the stock market. Index funds offer a diversified portfolio, reducing risk and increasing potential for long-term growth.

By understanding what index funds are, their benefits, and how to start investing, beginners can make informed decisions about their financial future. Index funds can be a great investment option for both beginners and experienced investors alike, providing broad market exposure and typically lower fees.

As you consider your investment strategy, remember that index funds are a valuable tool for achieving long-term financial goals. With their potential for steady growth and relatively low risk, index funds can be a great addition to a diversified investment portfolio.