Understanding APR vs. Interest Rate in Loans

When borrowing money, two crucial factors come into play: the interest rate and the Annual Percentage Rate (APR). While often used interchangeably, these terms have distinct meanings that can significantly impact your borrowing costs.

The interest rate is the cost of borrowing the principal loan amount, expressed as a percentage. On the other hand, the APR includes not only the interest rate but also other fees associated with the loan, providing a more comprehensive picture of the total cost.

Understanding the difference between these two financial metrics is essential for making informed decisions when taking out a loan. By grasping how interest rates and APRs work, borrowers can better navigate the lending landscape and avoid unexpected costs.

What Are Interest Rates and APR?

When diving into the world of loans, two key terms you’ll encounter are interest rates and APR. Understanding these concepts is vital for making informed decisions about borrowing money.

An interest rate is the cost you pay to the lender for borrowing money, expressed as a percentage of the loan amount. It’s essentially the fee charged by the lender for allowing you to use their money.

The Annual Percentage Rate (APR), on the other hand, includes not only the interest rate but also any additional fees charged by the lender, such as origination fees or late payment fees. The APR gives you a more comprehensive picture of the total cost of the loan.

To illustrate the difference, consider a loan with an interest rate of 6% and an origination fee of 1%. The interest rate remains 6%, but the APR would be higher, reflecting the total cost, including the fee. This makes APR a more accurate indicator of what you’ll actually pay over the life of the loan.

By understanding both interest rates and APR, you can better compare loan offers and choose the one that best suits your financial situation. Always look at both the interest rate and the APR to get a complete picture of the loan’s costs.

Understanding APR vs. Interest Rate in Loans

APR and interest rate are terms often used interchangeably, but they have distinct meanings in the context of loans. Understanding these differences is crucial for borrowers to make informed decisions.

Fees and Additional Costs

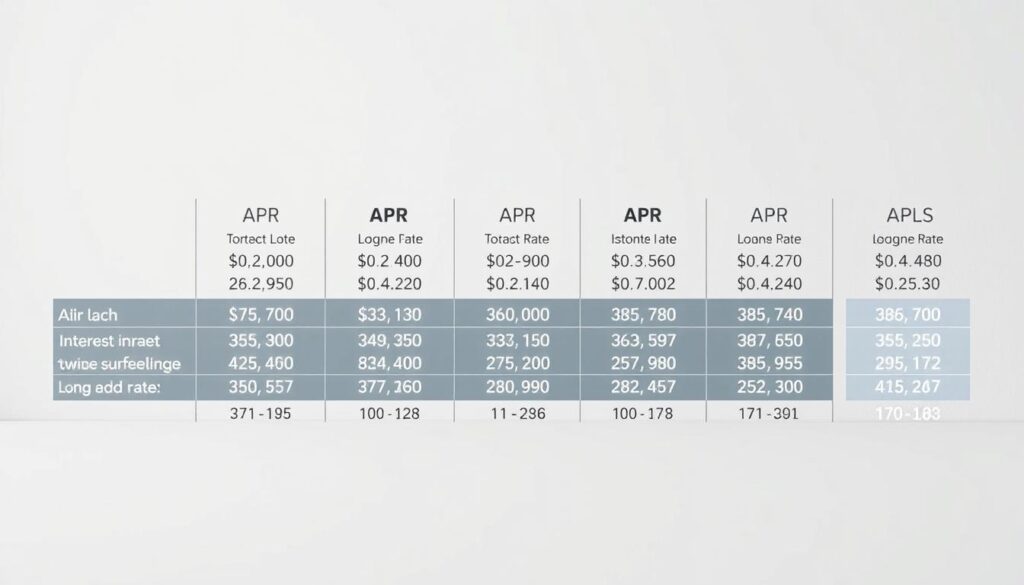

The APR includes not only the interest expense on the loan but also all fees and other costs involved in procuring the loan. This means that APR provides a more comprehensive picture of the loan’s total cost. Fees can include origination fees, late payment fees, and other charges. When comparing loans, looking at the APR gives you a more accurate comparison because it factors in these additional costs.

The compounding frequency affects how often interest is calculated and added to the loan balance. A higher compounding frequency can result in higher total interest paid over the life of the loan. Understanding how compounding works and how it impacts your loan can help you choose a loan with a more favorable interest rate and compounding schedule.

For instance, a loan with a lower interest rate but higher compounding frequency might end up costing more than a loan with a slightly higher interest rate but lower compounding frequency. It’s essential to consider both factors when evaluating loan options.

How APR and Interest Rates Affect Different Loan Types

The way APR and interest rates influence your loan depends on the type of loan you choose. Borrowers can use the APR as a good basis for weighing certain costs of loans, while also comparing actual underlying interest rates.

Fixed vs. Adjustable Rate Mortgages

For fixed-rate mortgages, the interest rate remains the same throughout the loan term, providing stability and predictability in monthly payments. In contrast, adjustable-rate mortgages have interest rates that can fluctuate based on market conditions, potentially leading to changes in monthly payments.

When comparing these mortgage types, the APR can be particularly useful. For fixed-rate mortgages, the APR gives a comprehensive view of the loan’s cost, including fees. For adjustable-rate mortgages, the APR is more complex due to the potential for rate changes, making it essential to understand the initial rate, adjustment frequency, and rate caps.

Promotional APRs are often used to attract new credit card customers, offering 0% APR for a specified period. Understanding the regular APR that will apply after the promotional period is crucial, as it can significantly impact the total cost if the balance is not paid off in time.

Balance transfers can also be affected by APRs. When transferring a balance to a new credit card, often to take advantage of a lower or 0% promotional APR, it’s essential to consider the balance transfer fee and the regular APR that will apply afterward.

By understanding how APR and interest rates affect different loan types, borrowers can make more informed decisions. Whether choosing between fixed and adjustable rate mortgages or navigating promotional APRs and balance transfers, being aware of these factors can help in managing loan costs effectively.

Tips for Comparing Loans Using APR and Interest Rates

Comparing loans can be a daunting task, but with the right knowledge of APR and interest rates, you can navigate the process with confidence.

When evaluating different loan options, it’s essential to understand that the lender offering the lowest nominal rate is likely to offer the best value. However, this isn’t the only factor to consider. APR provides a more comprehensive picture by including additional costs associated with the loan.

1. Look beyond the interest rate. While a lower interest rate might seem appealing, consider the APR, which includes other costs like origination fees and mortgage insurance.

2. Understand the loan terms. Different loans have varying repayment periods and conditions. Ensure you’re comparing loans with similar terms.

3. Calculate the total cost. Use the APR to determine the total cost of the loan over its lifespan. This will give you a clearer picture of which loan is more cost-effective.

By following these guidelines and understanding the difference between APR and interest rates, you can make a more informed decision when comparing loans. This knowledge empowers you to choose a loan that best fits your financial situation and goals.

Conclusion

When navigating the world of loans, grasping the difference between APR and interest rate is crucial for making informed financial decisions. While the interest rate determines the cost of borrowing money, the annual percentage rate (APR) provides a more comprehensive picture of the total borrowing cost.

By understanding APR vs. Interest Rate in Loans, borrowers can better compare loan options and avoid unexpected expenses. This knowledge enables individuals to make more informed decisions when selecting a loan, ultimately leading to a more stable financial future.

In conclusion, taking the time to understand the nuances between APR and interest rates can save borrowers from potential financial pitfalls. As you move forward with your financial planning, keep in mind that a clear understanding of these concepts is key to making the most of your loan options.